Last year alone, scammers walked away with $1.7 billion from crypto investors, according to Chainalysis. And most of those losses could’ve been avoided if people knew how to analyze a cryptocurrency project properly.

New projects pop up daily, each one promising to be the next Bitcoin or Ethereum. But here’s what nobody tells you: most will fail. Some are outright scams. Others just won’t deliver. That’s why learning to spot the good from the bad matters so much as we head deeper into 2026.

This guide walks you through the three core things you need to check: tokenomics (how the project’s economics work), the team (who’s actually building this thing), and utility (does anyone actually need it). Let’s get into it.

What Does It Mean to Analyze a Cryptocurrency Project?

To analyze a cryptocurrency project means you’re checking if it’s legitimate and has real potential in today’s evolved market. Think of it like buying a car. You wouldn’t hand over cash without checking the engine, right? Same deal here.

You’re looking at three main areas. First is tokenomics, which is basically the economics of the token. Second is the team verification, making sure real people with actual skills are behind it. Third is utility, whether the project solves a real problem that people have right now.

The goal isn’t to find the perfect project (it doesn’t exist). The goal is to avoid obvious scams and find projects with a fighting chance of succeeding as we move through 2026 and beyond.

Why Tokenomics Matter More Than Ever

Tokenomics is just a fancy word for how the token’s economy works. It covers supply, distribution, and what the token actually does. Get this wrong, and the project can tank even if the technology is brilliant. When you analyze a cryptocurrency project, tokenomics should be your starting point.

Supply Dynamics in 2026

Total supply tells you the maximum number of tokens that will ever exist. Bitcoin caps out at 21 million. That scarcity is part of why it holds value. Compare that to projects with an unlimited supply, where new tokens get created forever.

But here’s the trickier part for investors in 2026. Circulating supply matters more than total supply. A project might claim 10 billion total tokens, but if only 1 billion are available now, where are the other 9 billion? They’re probably locked up, waiting to hit the market and potentially crash the price.

Check out how major projects are handling supply as we progress through 2026:

| Project | Total Supply | Currently Available (2026) | How It Works |

| Bitcoin | 21 million | 19.8 million | Hard cap, mining reward halved in 2024 |

| Ethereum | No limit | 121 million | Burns fees to control inflation |

| Cardano | 45 billion | 36 billion | Fixed cap with gradual release |

| Solana | 580 million | 435 million | Decreasing inflation schedule |

Also Read: Liquidity Providers Explained: How to Earn Passive Income from DeFi in 2026

Token Distribution: Who Controls What

Token distribution shows you who holds the power. If the founders control 60% of all tokens, they can dump on retail investors any time they want. That’s a massive red flag, especially in 2026’s more mature market, where investors are getting smarter.

Look for projects where no single group controls more than 20%. Better yet, find projects that give 40-50% to the community through airdrops, rewards, or public sales. Every time you analyze a cryptocurrency project, check the distribution first.

Vesting schedules protect you from early dumps. Teams and early investors should have their tokens locked for at least a year or two. Gradual unlocking over 3-4 years is even better. You can check upcoming unlocks on sites like Token Unlocks to see what’s coming throughout 2026.

Understanding Token Utility

Some tokens let you vote on project decisions (governance tokens). Others pay for network services (utility tokens). Some represent ownership stakes (security tokens). The token needs a clear purpose beyond “it’ll go up in price.”

Burn mechanisms can help by reducing the supply over time. Ethereum burns part of every transaction fee. Binance manually burns BNB tokens each quarter. If demand stays constant while supply shrinks, basic economics says price should rise. This matters even more as DeFi matures in 2026.

How to Verify Teams in 2026

Anonymous teams should make you suspicious. Yes, Bitcoin’s creator stayed anonymous, but that was unique. Most legitimate projects today have public teams with verifiable backgrounds, especially as regulations tighten. When you analyze a cryptocurrency project, team verification is non-negotiable.

LinkedIn and Professional Verification

Look up each team member on LinkedIn. Do they have real profiles with work history? Check if they have connections and endorsements from real people. A CTO who previously worked at Microsoft or Google is more credible than someone with zero history.

For technical teams, check GitHub activity. Developers should have public code repositories showing their work. Look at how often they contribute and the quality of their code. If their GitHub account is dead or empty, that’s a problem when you analyze a cryptocurrency project in 2026’s competitive environment.

Critical Red Flags to Watch

Stock photos are a classic scam tactic that still works. Run any suspicious profile photos through reverse image search. Scammers steal images from modeling websites or other projects all the time.

Teams with zero technical expertise can’t build complex protocols. If everyone’s background is in marketing and business, who’s actually writing the code? You need at least some developers with proven technical skills, especially when you analyze a cryptocurrency project with complex smart contracts.

Multiple failed projects in someone’s history isn’t always bad. Startup failure is normal. But if someone has multiple exit scams or abandoned projects in their past, run away fast.

Advisor and Partnership Verification

Big names on the advisory board mean nothing if they’re not actually involved. Scammers pay influencers to add their names to websites without doing any real work. Check if advisors actually promote or discuss the project on their social media in 2026.

Partnership announcements need verification too. Companies like Microsoft, Amazon, and Visa get name-dropped constantly by projects with zero real connection. Visit the partner’s official website or social channels to confirm the partnership exists. This step alone can save you when you analyze a cryptocurrency project.

Evaluating Real Utility in 2026

Utility separates real projects from vaporware. You can have great tokenomics and a stellar team, but if nobody uses the product, the token has no fundamental value support. This is crucial when you analyze a cryptocurrency project for long-term potential.

The Problem Being Solved

What problem does this project actually solve? You should be able to explain it in one clear sentence. If you can’t, it’s probably overcomplicated or solving a problem that doesn’t exist.

Bitcoin solved digital scarcity. Ethereum enabled smart contracts. Chainlink connected blockchains to real-world data. These are clear, simple problems with clear solutions.

Is there real demand for this solution in 2026? Payment tokens need merchants to accept them. DeFi protocols need users borrowing and lending. NFT platforms need creators and collectors. Without demand, the best technology in the world is worthless.

Also, ask yourself: do traditional solutions already work better? Adding blockchain adds complexity and cost. The benefit needs to outweigh those disadvantages. Otherwise, it’s just blockchain for blockchain’s sake.

Competition Analysis

Check the competition. First-mover advantage helps, but execution matters more in 2026’s crowded market. Ethereum wasn’t the first smart contract platform, but it built the strongest developer ecosystem.

Compare the technical specs honestly. Look at transaction speed, fees, number of developers, and total value locked. Network effects create competitive moats. Ethereum dominates DeFi because developers and users are already there. New projects need 10x improvements to justify people switching.

Real Usage Metrics

Active addresses show actual usage. Check block explorers for daily and monthly active addresses. Growing numbers mean adoption. Flat or declining numbers suggest problems ahead. When you analyze a cryptocurrency project, on-chain metrics don’t lie.

Transaction volume reveals economic activity. High transaction counts with tiny values might just be bot activity. Look for organic growth patterns that match human behavior.

Developer activity signals long-term health. Projects with growing developer communities survive bear markets better. Check GitHub, Discord, and developer forums for activity levels.

Also Read: Best Crypto Wallets 2026: Secure Storage for Bitcoin & Altcoins

Technical Due Diligence Essentials

White papers should be technical documents, not marketing fluff. Read it and look for specific implementation details. Vague buzzwords without substance are warning signs, especially now that the industry has matured. Every time you analyze a cryptocurrency project, read the whitepaper thoroughly.

Security Standards in 2026

Smart contract audits from reputable firms are must-haves for DeFi projects. CertiK, Quantstamp, and Trail of Bits are industry standards. Audits don’t guarantee safety, but they show the team takes security seriously.

Bug bounty programs incentivize white-hat hackers to find vulnerabilities before bad actors do. Platforms like Immunefi host bounties for major projects. Active bounties with good rewards suggest the team has confidence in their code.

Open-source code allows the community to review everything. Closed-source projects in crypto raise immediate red flags. Transparency is supposed to be a core value here.

Network Architecture Evaluation

Consensus mechanisms affect security and decentralization. Proof-of-work (Bitcoin) uses lots of energy but has proven security over time. Proof-of-stake (Ethereum) is more efficient but concentrates power with large holders.

Watch for centralization points. How many nodes run the network? Who controls them? If a handful of validators control everything, it’s not truly decentralized no matter what the marketing claims. This matters when you analyze a cryptocurrency project for decentralization.

Understanding the 30 Day Rule

The 30-day rule refers to the wash sale rule, which prevents investors from claiming tax losses if they sell an asset at a loss and repurchase it within 30 days. Here’s the interesting part: this rule applies to stocks and securities, but as of early 2026, still hasn’t been officially applied to cryptocurrencies in the US.

Right now, crypto investors can sell at a loss, claim the tax deduction, and buy back the same crypto immediately. It’s a legal tax strategy, but it won’t last forever. The Biden Administration proposed including crypto in the wash sale rule back in 2024, and experts think it’ll happen soon, possibly later in 2026.

Cautious investors are already waiting 30 days before repurchasing to avoid future problems when the rule inevitably changes. Better safe than sorry.

The 1% Risk Management Rule

The 1% rule means you never risk more than 1% of your total trading capital on any single trade. This is professional risk management at its core, and it’s more important than ever in volatile markets.

Here’s how it works. If you have $20,000 in your account, you limit your risk to $200 per trade. You achieve this using position sizing and stop-loss orders.

Why does this matter? With the 1% rule, ten consecutive losses only create a 10% drawdown, requiring just an 11% gain to recover. Compare that to risking 10% per trade, where ten losses wipe out your entire account.

The 1% rule isn’t about limiting profits. It’s about surviving long enough to be profitable. Professional traders focus on preserving capital over maximizing returns. That’s the mindset shift that separates amateurs from pros.

Also Read: Pi Cryptocurrency Explained: Mining, Value & Future Potential in 2026

Community Signals That Predict Success

Community strength predicts survival better than most metrics. Projects with engaged communities weather bear markets. Those with passive followers don’t. When you analyze a cryptocurrency project, community engagement reveals future potential.

Quality Over Quantity

Social media follower counts are meaningless. Bots and paid followers inflate numbers easily. Look at engagement rates instead, likes, comments, and shares relative to follower count.

Discord and Telegram groups show real community health. Active discussions and technical questions indicate genuine interest. Groups full of price speculation and moon memes suggest a gambling mentality.

Reddit provides unfiltered opinions. Search for the project on cryptocurrency subreddits. Honest criticism is healthy. Pure echo chambers that praise everything are suspicious.

Regulatory Compliance in 2026

Regulatory status matters for long-term survival, especially as 2026 brings more regulatory clarity. Projects in legal gray areas risk sudden shutdowns. Check if the team has legal counsel and follows securities laws.

Geographic restrictions show regulatory awareness. Blocking US users means the team understands SEC scrutiny. Accepting everyone without KYC might mean they’re ignoring regulations entirely, which is riskier than ever.

Regular updates and transparent communication build trust. Clear roadmap adjustments and honest discussion of challenges show professionalism. Smart investors analyze a cryptocurrency project by checking how teams communicate with their community.

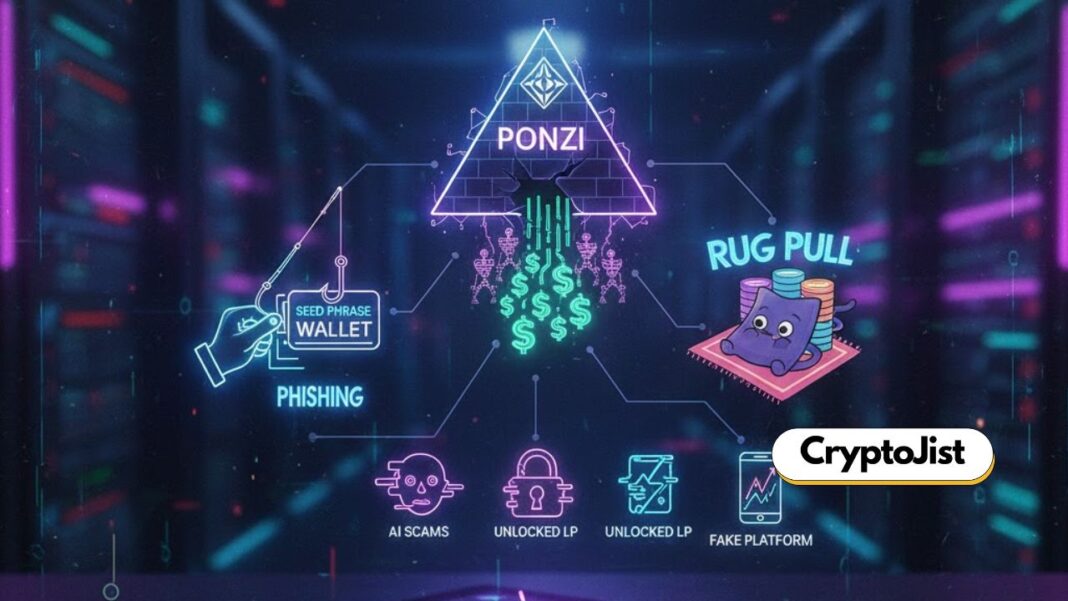

Red Flags to Avoid Always

Guaranteed returns are always scams. Always. Nobody can promise specific returns in crypto. Anyone claiming guaranteed 20% monthly gains is running a Ponzi scheme, and these still exist in 2026.

Pressure to buy immediately exploits FOMO. Legitimate projects don’t need artificial urgency. “Limited time” token sales that keep extending are manipulation tactics.

Unrealistic roadmaps promise too much too fast. Building blockchain infrastructure takes years. Projects claiming to launch 10 major features in six months are lying or incompetent.

Anonymous teams with large premines combine two major red flags. If developers are anonymous and control most tokens, they can exit scam easily. Always analyze a cryptocurrency project’s team transparency and token distribution together.

Practical Research Checklist for 2026

Before putting money into any project, work through this framework to properly analyze a cryptocurrency project:

Tokenomics Check:

- Look up total and circulating supply on CoinMarketCap or CoinGecko

- Review distribution using blockchain explorers like Etherscan

- Verify vesting schedules on the project website

- Understand what the token actually does

Team Verification:

- Search each member on LinkedIn for work history

- Check GitHub for developer activity

- Verify partnerships through official channels

- Research past projects and reputation

Utility Assessment:

- Define the problem in one sentence

- Compare to existing solutions and competitors

- Check user metrics on block explorers

- Evaluate technical advantages

Risk Check:

- Read smart contract audit reports

- Check for active bug bounties

- Assess decentralization and security

- Review regulatory compliance status

Common Investment Mistakes

Falling for paid promotions is easier than you think. Influencers get thousands of dollars to shill projects. Watch for disclosure statements. Be skeptical of hype. When you analyze a cryptocurrency project, ignore influencer hype completely.

Ignoring tokenomics while obsessing over technology is backwards. The best technology fails without sound economics. Both matter equally.

FOMO buying based on price action alone misses fundamentals. Prices pump right before dumping all the time. Understanding why something is rising matters way more than the rise itself.

Also Read: Deep Dive Into Layer 1 (L1) Blockchain

Where to Find Reliable Information

CoinMarketCap and CoinGecko give you basic data on supply, price, and market metrics. Start here for quick overviews whenever you analyze a cryptocurrency project.

Block explorers like Etherscan show real on-chain data. Transaction patterns, holder distribution, and contract interactions reveal actual usage beyond marketing claims.

Project documentation and GitHub repositories contain technical details. Read the docs to understand how things actually work instead of relying on summaries.

Community channels like Discord and governance forums show real discussions. These conversations reveal problems the marketing materials hide.

Best Analysis Tools for 2026

DeFi Llama tracks total value locked across protocols. TVL indicates trust and adoption in decentralized finance. Use this when you analyze a cryptocurrency project in the DeFi space.

Dune Analytics provides custom blockchain data dashboards. Users create visualizations showing growth, revenue, and other metrics.

Nansen offers wallet tracking and smart money flows. Professional investors use this to identify where institutions are moving funds.

Token Terminal shows financial metrics for crypto protocols. Revenue, fees, and earnings help you value projects like traditional companies.

Verifying Project Legitimacy

Start with the basics. Does the project have a working product? Can you test it? Many scams are all marketing with zero actual product. This is the first thing to check when you analyze a cryptocurrency project.

Check the code. Is it open source? Has it been audited? Who audited it, and what did they find? Legitimate projects are transparent about their code and security.

Look at the community response. What are people saying on Reddit, Twitter, and in crypto forums? Are the only positive comments from brand new accounts?

Verify everything independently. Don’t trust screenshots or claims on the project website. Go to the blockchain explorer yourself. Check partnerships directly with the partner company.

Team Evaluation Strategies

Start by making a list of all team members. Then research each one individually. This step is essential when you analyze a cryptocurrency project for legitimacy.

Google their names. Do they have a digital footprint? Articles, interviews, conference talks? Real professionals leave traces.

Check their previous projects. Go to their LinkedIn and see what they built before. Did those projects succeed or fail? Were they abandoned?

Look for inconsistencies. Do their skills match their role? A technical role filled by someone with zero coding background is a red flag.

Try to contact them. Join their Discord or Telegram. Real teams engage with their community. Fake teams hide or use excuses.

Tokenomics Analysis Tools

Token Terminal gives you financial data like protocol revenue and fees. This helps determine if a project generates real value. Use this tool whenever you analyze a cryptocurrency project’s economics.

TokenUnlocks.app tracks vesting schedules and upcoming token releases. You’ll know exactly when large amounts of tokens hit the market.

Etherscan (or equivalent explorers) shows holder distribution. You can see if whales control most tokens or if distribution is healthy.

The project’s own documentation should explain tokenomics clearly. If they don’t explain it well, that’s a red flag in itself.

Finding Quality Whitepapers

Project websites usually host whitepapers directly. Look for a “Docs” or “Resources” section when you analyze a cryptocurrency project initially.

For major projects, try the Messari crypto research platform. They host whitepapers and provide additional analysis.

Always read the original whitepaper from the official source. Don’t trust summaries or third-party interpretations. Scammers sometimes create fake whitepapers for real projects.

Real-Time Analytics Platforms

Dune Analytics offers customizable dashboards created by the community. You can see real-time data on user activity, revenue, and more.

CoinGecko shows live price data, volume, and market cap changes. Their developer activity stats are useful too.

DefiLlama specializes in DeFi metrics. Total value locked, protocol revenue, and user counts are updated regularly.

Nansen tracks wallet activity in real-time. You can follow smart money movements and whale transactions. Professional investors analyze a cryptocurrency project using multiple data sources like these.

Also Read: Why Liquid Staking Tokens (LSTs) Matter In 2026?

Measuring Community Engagement

Check Twitter/X followers and engagement rates. Divide likes and retweets by follower count. Rates below 1% suggest fake followers.

Join their Discord or Telegram. How many members are online? How active is the chat? Are people asking technical questions or just spamming moon memes?

Look at GitHub activity for open-source projects. Regular commits and active pull requests show ongoing development.

Check Reddit mentions and sentiment. Search the project name on r/cryptocurrency and see what people honestly think. This social listening matters when you analyze a cryptocurrency project.

Development Activity Tracking

GitHub shows all development activity for open-source projects. Check commit frequency, number of contributors, and issue resolution.

Electric Capital releases annual developer reports ranking crypto projects by developer activity. This provides a good overview of the ecosystem.

Some projects use tools like Gitcoin to fund development. Check their Gitcoin profile to see what bounties they’re offering and who’s claiming them.

Security Audit Verification

Visit the project’s documentation. Security audits should be published and easy to find. Always check audits when you analyze a cryptocurrency project.

Go directly to the audit firm’s website. Major firms like CertiK, Quantstamp, and OpenZeppelin publish audit reports on their own sites.

Check if the project fixed the issues found in audits. An audit that finds 10 critical issues means nothing if the team ignored them.

Look for multiple audits from different firms. One audit is good. Three audits from reputable firms are better.

Researching Project Roadmaps

The project’s official website and documentation are primary sources. Look for a “Roadmap” section.

Their official blog or Medium publication often contains detailed updates on roadmap progress.

GitHub milestones show technical roadmap progress. You can see what features are planned and how far along they are.

Community forums and Discord channels provide unofficial updates. Teams often share roadmap details before official announcements. Check these when you analyze a cryptocurrency project’s development trajectory.

Understanding Market Cycles

Bull markets hide problems. Everything goes up, making even terrible projects look successful temporarily. Real quality shows in bear markets.

Bear markets test fundamentals. Projects with real users and revenue survive. Those relying purely on hype die off.

Timing matters less than quality for long-term investing. Good projects bought in bear markets typically outperform mediocre projects bought in bulls. Remember this principle every time you analyze a cryptocurrency project.

AI Tools for Analysis

ChatGPT and similar AI tools can’t analyze live crypto charts because they don’t have real-time market access. They can explain technical analysis concepts and patterns, but can’t tell you what to buy or sell right now.

Some platforms integrate AI with real-time data. TradingView has AI features, and some crypto exchanges are adding AI analysis tools. But remember, these tools analyze historical patterns; they don’t predict the future.

Which AI is best for crypto prediction? None. No AI can consistently predict crypto prices. They can identify patterns and trends, but the market is influenced by too many unpredictable factors.

Is ChatGPT’s crypto advice reliable? Take it with a grain of salt. ChatGPT provides general information and educational content. It shouldn’t be your only source for investment decisions. Always verify information and do your own research.

Code Analysis Strategies

First, find the code repository, usually on GitHub. Most legitimate projects are open-source. This is essential when you analyze a cryptocurrency project’s technical foundation.

Look at the commit history. Regular, consistent updates suggest active development. Long gaps or sudden activity spikes can be concerning.

Check the code quality. Even if you’re not a programmer, you can see if the code is well-organized and documented. Professional projects have clean, commented code.

Read through issues and pull requests. How does the team respond to bug reports? How quickly do they fix problems? This shows their commitment to quality.

For complex analysis, hire a security professional or use audit services. Don’t rely solely on your own assessment unless you’re an experienced developer.

How do you analyze a cryptocurrency project effectively?

To properly analyze a cryptocurrency project, start with tokenomics by checking supply metrics, distribution, and vesting schedules. Then verify team members on LinkedIn and GitHub. Confirm the project solves a real problem with actual user demand. Use block explorers to verify on-chain activity. The whole process takes at least 5-10 hours for serious investments in today’s competitive market.

How to turn $1000 into $10000 in a month?

Let’s be honest: you probably can’t, and anyone promising you can is lying. Turning $1,000 into $10,000 requires a 900% return in 30 days. That level of gain requires either massive risk or incredible luck, usually both. Most professional traders aim for 10-20% monthly returns at best. Focus on consistent gains over time, not get-rich-quick schemes that’ll likely lose your money.

Is 1% return a day good?

A 1% daily return is exceptional if sustained. That compounds to over 3,600% annually. No professional trader maintains this consistently. Daily returns fluctuate wildly. Some days you lose, some days you win big. The goal isn’t 1% daily but positive returns over weeks and months. Be suspicious of anyone claiming they consistently make 1% daily.

Which crypto projects could deliver major returns in 2026?

Nobody knows with certainty which projects will deliver massive returns. When you analyze a cryptocurrency project, focus on fundamentals: low market caps, strong tokenomics, verified teams, real utility, and growing adoption metrics. Historical examples like Solana and Chainlink showed these characteristics before major breakouts. Rather than chasing specific predictions, master the analysis framework to identify quality projects yourself.

How to Prepare for Crypto Taxes in 2026?

Yes, in most countries including the US, you’ll be taxed on crypto profits. Capital gains from crypto are taxable just like stocks. How much tax depends on your country, income bracket, and how long you held the crypto. Short-term gains (under a year) typically face higher tax rates than long-term holdings. For 2026, expect potential new regulations including the wash sale rule being applied to crypto. Keep detailed records of all transactions, dates, and amounts. Consider using crypto tax software like CoinTracker or Koinly. Consult a tax professional familiar with crypto for your specific situation before tax season.

Can you connect TradingView to ChatGPT?

Not directly through official integrations. Some developers have created third-party tools that attempt to bridge the two, but these aren’t officially supported. TradingView has its own Pine Script language for creating indicators and strategies. That’s more powerful than trying to connect external AI tools.

What is the 1% risk per trade rule?

The 1% risk rule means limiting potential losses on any single trade to 1% of your total capital. For a $10,000 account, risk only $100 per trade. You achieve this through proper position sizing and stop-loss placement. This protects you from devastating losses during inevitable losing streaks.

What is the 1% rule in day trading?

Day traders follow the 1% rule by never risking more than 1% of their account on any trade. This differs slightly from position sizing. Your position might be 10% of your account, but your stop-loss placement ensures your maximum loss is only 1%. This rule helps traders survive losing streaks that every trader faces.

Get the news in a Jist. Follow Cryptojist on X and Telegram for real-time updates!

Disclaimer:

Look, we’re just journalists reporting the news here, not your financial advisors. Everything you read above is for information purposes only. Crypto is wild, unpredictable, and can absolutely wreck your savings if you’re not careful. Never invest money you can’t afford to lose. Seriously, we mean it. Do your own research, talk to actual licensed financial professionals, and remember that past performance means absolutely nothing when it comes to future results. The crypto market can turn on a dime, and what’s hot today might be toast tomorrow. We’re not responsible for your investment decisions, good or bad. Trade smart, stay safe, and don’t bet the farm on anything you read on the internet, including this article.