Introduction

It’s been a long wait for Zcash holders — seven years, to be precise. After years of being overshadowed by newer narratives and shinier altcoins, ZEC is finally back in the spotlight, crossing the $750 mark and turning heads across the crypto market.

But what exactly triggered this sudden surge? Let’s break it down — not in textbook jargon, but in plain, human terms.

A Comeback Years in the Making

For a long time, Zcash felt like a forgotten gem. It was one of the earliest privacy-focused cryptocurrencies, launched back in 2016 with a mission to give people financial privacy — something Bitcoin couldn’t fully offer.

But as the years went by, the hype shifted to DeFi, NFTs, and AI tokens. Privacy coins faded into the background.

This 2025 rally feels different. It’s not a random pump — it’s the return of a narrative.

Privacy Is Back in Demand

Over the past year, governments around the world have been tightening their grip on financial surveillance. KYC laws, transaction monitoring, and CBDCs have reignited a simple but powerful question: “What happened to financial privacy?”

That’s where ZEC comes in — the project that always stood for privacy when it wasn’t cool to do so.

Now, as global tensions rise and people seek control over their financial data again, Zcash is finding relevance in a world that suddenly remembers why privacy matters.

Upgraded Tech, Renewed Confidence

Zcash isn’t just surviving — it’s evolving. The team has steadily improved scalability, reduced fees, and enhanced shielded transaction capabilities.

In 2024–2025, several upgrades bridged ZEC’s tech closer to mainstream DeFi compatibility, making it easier for users to transact privately without giving up speed or liquidity.

This technical maturity has restored investor confidence — especially among those who value fundamentals over hype.

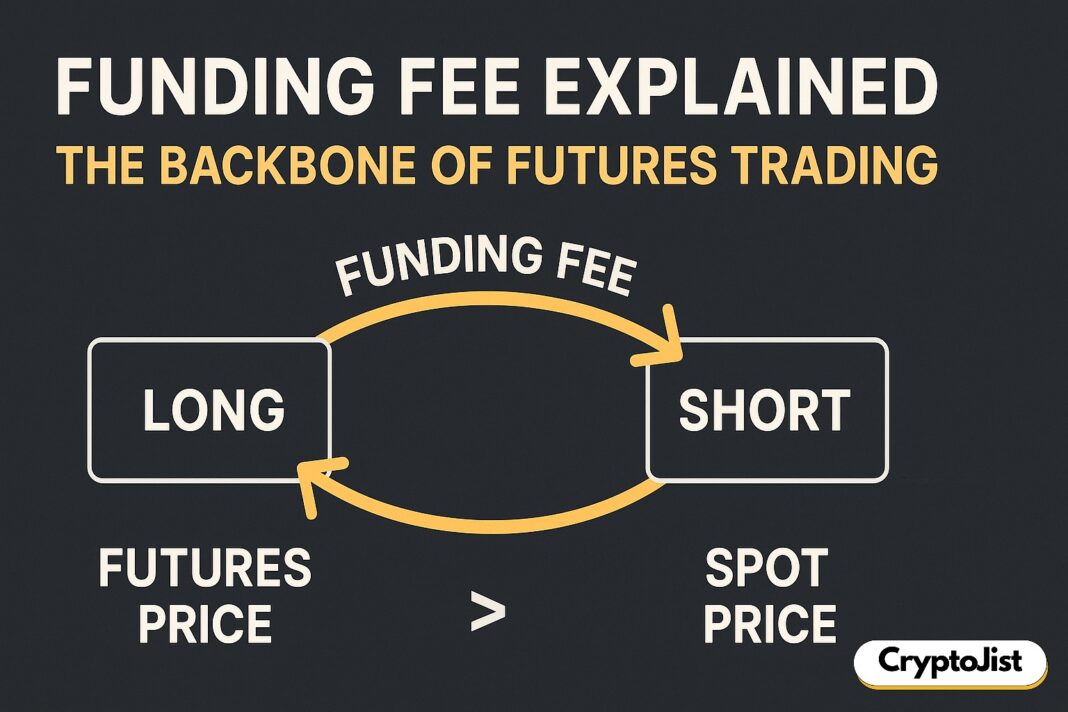

The Hidden Catalyst: Negative Funding Fees

If you noticed the recent negative funding fee of -0.35%, that played a big role in ZEC’s explosive move.

In perpetual futures markets, a negative funding fee means shorts are paying longs — signaling that too many traders were betting against the coin.

When funding stays negative for too long, it often sets the stage for a short squeeze — exactly what happened here.

As shorts got liquidated one after another, ZEC saw massive wicks to the upside, pushing prices higher in a matter of hours.

This shows how market structure and sentiment can align perfectly with narrative strength to fuel a powerful rally.

Arthur Hayes, Market Momentum, and Timing

Of course, no crypto rally happens in isolation. Influential figures like Arthur Hayes publicly expressing bullish sentiment on privacy coins gave the movement extra fuel.

And with Bitcoin consolidating after massive runs, traders started looking for undervalued narratives — and ZEC, trading way below its historical highs, was an obvious candidate.

Once it started moving, momentum took over. Traders jumped in, algorithms followed, and before you knew it, ZEC was flying past resistance levels.

What This Run Really Means

ZEC’s rise isn’t just about price — it’s a reflection of where the crypto world’s mindset is heading.

People are slowly realizing that decentralization without privacy is incomplete. As data becomes the new oil, owning your financial footprint becomes the ultimate form of freedom.

So yes, $750 is just a number on the chart. But the story behind it? That’s years of conviction, innovation, and rediscovery coming full circle.

Final Thoughts

Zcash hitting $750 after 7 years isn’t just a comeback — it’s a quiet reminder that in crypto, values always find their way back into value.

Privacy coins may have been asleep, but they were never dead.

And maybe, just maybe, this is the start of their long-overdue redemption arc.