Polymarket has become more than a prediction market. It has turned into a high-stakes arena where information, conviction, and timing collide. Over the past two years, a few bets didn’t just win, they shook the entire crypto conversation.

Here are five Polymarket plays that delivered massive multipliers, in some cases touching 20× to 100× returns.

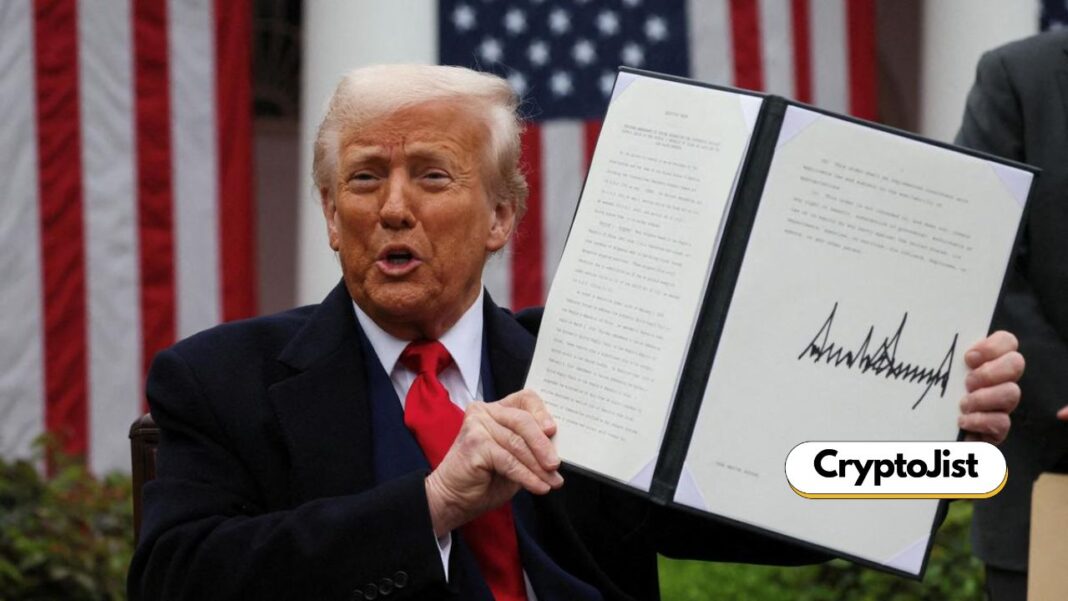

1) Trump Election Bet

During the 2024 U.S. presidential race, a massive whale built large positions on Donald Trump winning. When the outcome resolved in his favor, the payout reportedly ran into tens of millions of dollars.

While the exact blended entry prices varied across markets, early entries at low probabilities turned into extraordinary returns. This single trade changed how people view political prediction markets. It proved serious capital was flowing into Polymarket, not just retail speculation.

Impact on crypto:

- Showed prediction markets can rival traditional betting markets.

- Attracted institutional-level attention.

- Sparked debates around whale dominance.

2) Maduro Capture Market

One of the most controversial trades came from a newly created wallet betting on Nicolás Maduro leaving office. The account reportedly turned roughly $30–40K into over $400K in a short span.

That’s around a 10×–12× verified return. Some entries were even lower, implying higher effective multipliers for specific contracts.

Impact on crypto:

- Raised insider trading concerns.

- Triggered regulatory discussions.

- Highlighted how real-world geopolitical events can generate explosive returns.

This was the moment people realized prediction markets can become information battlegrounds.

3) Google “Year in Search” Sweep

A single wallet accurately predicted multiple Google Year in Search outcomes and reportedly netted around $1M in profit within a short time frame.

Some individual legs were purchased at very low prices and later resolved at full payout, implying 20×–50× style returns depending on entry timing.

Impact on crypto:

- Sparked insider speculation.

- Increased wallet tracking behavior.

- Pushed more traders to analyze on-chain data seriously.

It shifted Polymarket culture from casual betting to forensic analysis.

4) Short-Duration Micro Markets

Polymarket’s fastest markets, press conference length, surprise announcements, same-day political events have produced some of the wildest multipliers.

In thin liquidity conditions, contracts trading at a few cents have flipped to full payout within minutes. Community-reported cases show 20×, 50×, and even near-100× returns when someone entered at extreme odds before a surprise outcome.

Impact on crypto:

- Turned Polymarket into a volatility playground.

- Encouraged high-risk, high-reward scalping.

- Attracted short-term speculators from futures markets.

These markets behave more like options than traditional bets.

5) Bitcoin Threshold Bets

Crypto price threshold markets: such as “Will BTC cross X price by Y date?” have quietly produced massive multipliers.

In sharp market reversals, contracts bought at $0.01–$0.03 have spiked to $0.70–$1.00 as sentiment flipped. That’s where 50×–90× returns have appeared, especially during volatile weeks.

Impact on crypto:

- Used as hedging tools by traders.

- Became speculative lottery tickets for retail.

- Blended DeFi psychology with prediction markets.

These plays connect Polymarket directly to the broader crypto trading ecosystem.

Why These Bets Matter

These weren’t just lucky wins. They disrupted the crypto space because they:

- Proved prediction markets can move serious money.

- Showed whales can dominate outcomes.

- Highlighted insider risk.

- Created on-chain transparency narratives.

- Turned Polymarket into a cultural phenomenon within crypto Twitter.

Polymarket is no longer just about predicting outcomes. It’s about timing, liquidity, psychology, and information flow.

And while 20× to 100× returns are possible, they usually come from:

- Low liquidity

- Early conviction

- High uncertainty

- Perfect timing

For every 50× screenshot you see online, there are dozens of zeroed-out positions nobody posts.

Still, these five bets proved one thing clearly:

Prediction markets are now part of the crypto game.

Read also: https://cryptojist.com/nft-sales-crash-bitcoin-dump-2025/

Get the news in a Jist. Follow Cryptojist on X and Telegram for real-time updates!